By Malcolm McDonald, Emeritus Professor of Marketing, Cranfield University School of Management

Our definition of a value proposition is “the translation of the supplier’s offers into monetary terms that demonstrate their contribution to the customer’s profitability.” The key phrase here is “customer profitability,” because if you can prove that dealing with you will make your customer richer, they will buy from you.

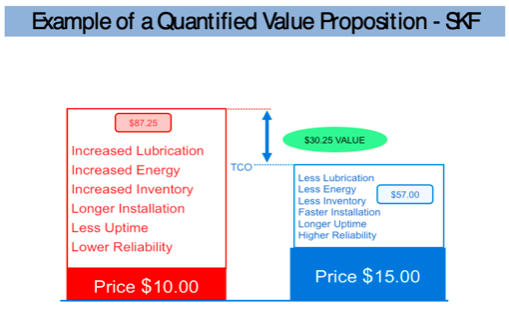

Even a cursory glance at the pricing example below from global engineering group SKF illustrates the dramatic impact that is possible as a result of preparing financially quantified value propositions.

This is why value propositions are so important in business today and why it is crucial to quantify them financially, a task which one would think is comparatively easy since there are only three ways in which monetary value can be created for customers:

- Adding value (e.g. revenue gains, improved productivity, service enhancement, speed, etc.)

- Reducing cost

- Avoiding cost

There is, it should be said, a fourth form of monetary customer value, namely: emotional contribution. This is much more difficult to quantify financially, but suffice it to say that, all things being equal in benefit terms and price, most customers will opt for a brand they know and trust.

The benefits of financially quantified value propositions

Financially quantified value propositions will help you increase profitable sales for a number of reasons:

- Per McKinsey & Co., fewer than 5% of companies have financially quantified value propositions, so developing them will differentiate your company in the eyes of your customers.

- Even if your products and services lack actual differentiation, the very act of financially quantifying the benefits, even if they are standard benefits, will give you an advantage over your competitors.

- You will close more deals, typically an additional two to five percent.

- It will help you reduce discounting by between 20 and 30 percent.

- As a result, deals will be bigger (typically by at least 10 percent).

- It will help make your marketing campaigns more productive.

- You will enjoy improved customer relationships.

- Your relationships will last longer.

- You will enjoy referrals from satisfied customers.

- You will have fewer no decisions and delayed decisions.

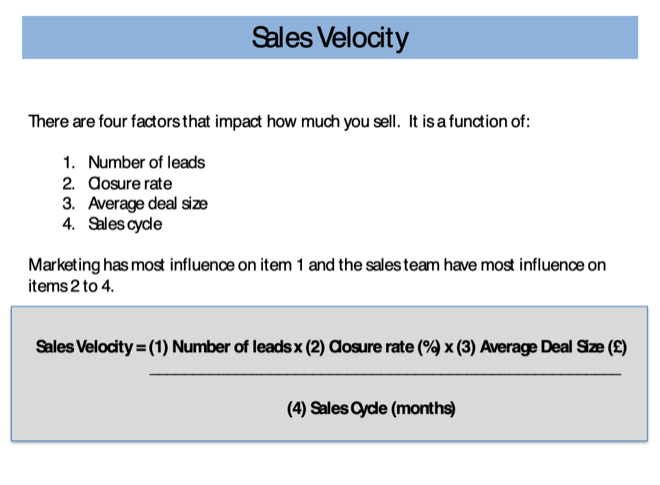

Let us give a quick summary of just one of the above benefits – sales velocity – illustrated in the figures below.

As many of you already know, as much as 90 percent of the buying cycle today occurs before buyers even speak to suppliers. Such is the power of the internet. Today’s buyers who can easily research an entire marketplace in minutes certainly don’t need someone to connect them with products any more. What they do need is honest advice about how to grow their business profitably. Today’s buyers can easily tell when someone is just trying to sell them products.

There is, after all, only one lasting route for any supplier to grow its profits: by creating demand from customers by creating value for them. It’s the only sustainable future. However, there is a world of difference between merely helping your customer avoid disadvantage and creating advantage for your customer. What do I mean?

Most products and services fulfill functions that customers need, in the sense that they can’t do without them. For example, a restaurant needs tables and chairs, an airline needs planes, an office needs computing capability and so on. The problem, however, is that these organizations always have a choice of suppliers, and since most products today work perfectly well, they will mainly buy on price — unless a supplier can prove that they will create advantage for them.

We have already explained that it is possible to succeed by financially quantifying standard benefits when other competitors don’t, but this is unlikely to lead to sustainable success. The process of creating advantage for the customer, however, will lead to sustainable success.

I invite you to take the value propositions self-assessment below, which will give you a good idea of how your company is doing in terms of quantifying its value propositions. For the 12 questions that follow, please answer with (1) “Strongly agree,” (2) “Partly agree,” (3) “Do not agree or (4) “Don’t know.”

- “Our return on capital is satisfactory, and there is good evidence that it will stay that way for the foreseeable future.”

- “Our turnover is increasing.”

- “But not at the expense of profitability.”

- “We do not sell unprofitably to any customer.”

- “We analyze our cost-to-serve customer figures to be sure of this.”

- “If we do, it is for rational reasons known to us all.”

- “We are wholly satisfied that we offer what the market wants rather what we prefer to sell.”

- “Our value propositions consider the combined effect of all external factors that have an impact on the customer.”

- “Our value propositions take account of our own deep understanding of the customer’s value chain, their financial ratios and all other internal factors that affect their performance.”

- “We can clearly state the reasons customers should buy from us rather than from competitors and can prove the financial impact on the customer’s bottom line.”

- “We have strong proof to substantiate this.”

- “Our value propositions create advantage for our customers, rather than only helping them to avoid disadvantage.”

A significant number of “Partly agree,” “Do not agree” and “Don’t know” answers indicates that you may have a lot of work to do on your value propositions.

“Me too” organizations

In spite of the evidence, it is remarkable that, as we mentioned earlier, only 5 percent of companies in the U.K. have financially quantified value propositions. Our own research indicates a much lower percentage. Indeed, my work with the European Institute of Purchasing, in Geneva, and with the buying directors who are invited to address suppliers at my Cranfield School of Management Key Account Management Best Practice Research Club, report that only 1 percent of their suppliers have financially-proven value propositions. And for those suppliers, they are prepared to pay a premium of up to 25 percent to deal with them.

We recently interviewed a buying director in the National Health Service in the U.K., one of the largest organizations in the world. He reported being surprised at the expressions on the faces of sellers of Information Technology/Information Systems when asked for a financial justification for the substantial prices they were demanding. In my own experience, if you ask a marketing manager for financially quantified value propositions for any product for market, it will often elicit a blank expression — which makes us wonder what they think their role is.

It is blindingly obvious that, in the absence of financially quantified value propositions, buyers will inevitably drive prices down, and unless your business costs are lower than everyone else’s, discounting is a losing game.

The dreaded websites

Most websites appear to say the same things, things like:

- “Our products have great quality.”

- “We have an outstanding reputation.”

- “We are trustworthy.”

- “We are the market leader in _____.”

- “We help our customers get exceptional results.”

- “Our customer service is excellent.”

- “We are very innovative.“

In other words: “Me, me, me, me, me!” These suppliers all sound the same, and their marketing is usually on the supplier’s, rather than the customer’s, needs. Any operating board of a company that cannot explain why customers should buy their products rather than those of competitors should replace their Chief Marketing Officer.

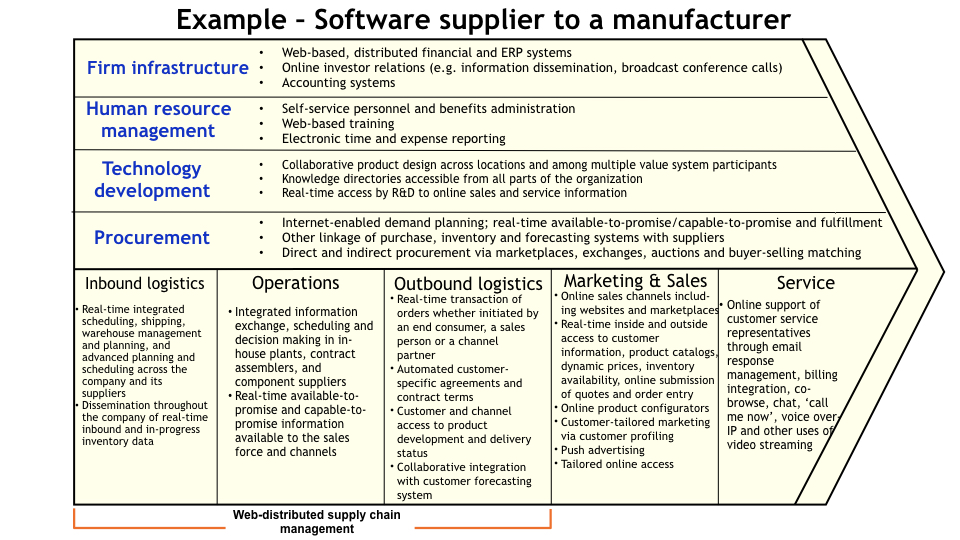

The components of a value proposition and added value

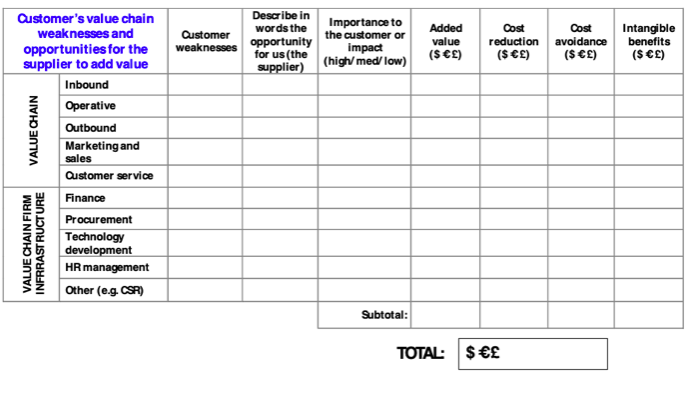

There are many ways a supplier can add value to their customers’ business. The list is too long and complex to set out here, but a comprehensive example is shown below in relation to an Information Systems/Information Technology supplier. This figure illustrates the detailed use of Porter’s Value Chain as an analysis tool to delve into every aspect of a customer’s business from beginning to end.

Porter’s Value Chain

Improved productivity can come in many forms, such as revenue gains for the customer by:

- Enhancing the end-use flexibility of the customer’s product

- Improving the quality and reliability of the their product

- Adding functions or new applications to the their product

- Improving post-service value

- Increasing the customer’s production capacity or speed

- Enabling more, or more productive, sales calls

- Enabling price increases

- Reducing debtor days

- Speeding up time to market for new product launches

- Improving agility

- Improving intelligence/insight

- Improving the accuracy of the customer’s sales forecasts

- Risk reduction through reducing the customer’s cost of capital

Cost reduction and cost avoidance are perhaps the easiest to quantify financially, and the case from SKF shown above is a classic example of how to charge a high price up front by justifying a significant reduction in lifetime costs.

But companies such as SKF, General Electric, 3M and the like have substantial databases of examples by sector and company size that prove the financial benefits of their products and services. They also have computerized models to enable the sales force to apply them to individual customers.

This process works just as well for small companies, as can be seen from the example of the label company given below.

Developing value propositions

There are two main domains for which value propositions need to be developed. The first is in those parts of the market shown in the center of figure 7. The other is in the strategic account domain shown in the top right.

Financially quantified value propositions for strategic accounts

We can now turn at last to the main purpose of this post, which is teach you how to prepare financially quantified value propositions for your strategic accounts. You will of course understand that if you are to be successful, there is an awful lot of preparation required. First, you will need to do some critical homework, including:

- STEP ONE: Targeting those strategic accounts where you are most likely to get the best results

- STEP TWO: Listing the macro-environmental challenges and issues (i.e., PEST: political, environmental, social, technological) confronting your strategic customers

- STEP THREE: Summarizing Porter’s Five Forces’ analysis

- STEP FOUR: Summarizing the customer’s annual report and the financial challenges facing them

- STEP FIVE: Summarizing the customer’s value chain using as an example the chart labeled “Porter’s Value Chain”

- STEP SIX: Gaining an in-depth understanding of the customer’s buying process

These steps are too complex to spell out here but are essential to the preparation of value propositions.

Provided you have done all the work of steps one through three (“Define target market,” “Identify buyers” and “Added value analysis”), you are now ready to financially quantify your value proposition. Now we are glad to offer you our unique proprietary summary of all the foregoing.

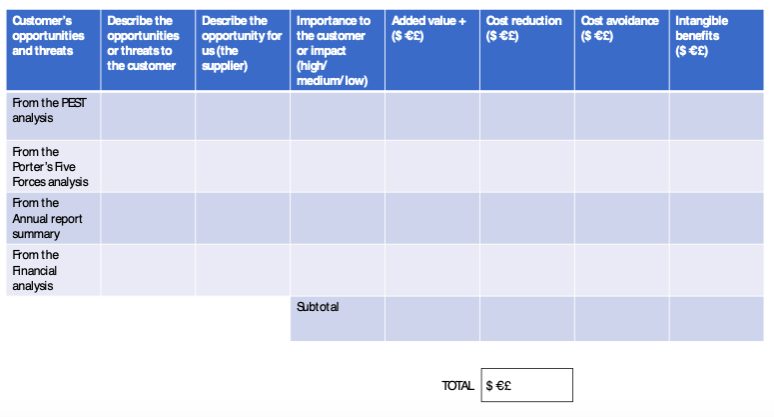

The following table summarizes all the analysis referred to above except Porter’s Value Chain, and it represents a major part of step four (i.e., “Financial quantification”) above.

Next, we bring you the single most important figure in this post, because it summarizes everything we have said about how to develop financially quantified value propositions for strategic accounts as a result of Porter’s Value Chain Analysis. This also plays a major part of step four of the process outlined above.

The following graphic shows what a summary might look like as a result of going through the process outlined above:

The penultimate step

Before presenting your financially-quantified value proposition to your customer, there is, however, one further piece of work to be done: You will need to classify it according to the structure below. This corresponds to step five (“Categorize”) in the six-step value proposition process above.

The reason for this is that not all financially quantified value propositions have the same immediate value, and so if you are able to categorize and present them like this, you will stand a much better chance of being listened to and, more importantly, understood. All that remains now is step six (“Communication to target customers/markets”), which will be the topic of a future blog post.

The final piece

This is not the place to go into lengthy and complex explanations of return on investment (ROI), internal rate of return (IRR), net present value (NPV) and payback, but particularly for more sophisticated customers it is necessary to calculate the financial return on what are frequently substantial sums invested in purchasing goods and services

Some customers are interested only in payback over a 12-month period. Others are looking at return on investment over a longer timeframe. Each method attempts to summarize a set of cash flows from a project into a single indicator. Each has its intended purpose, and each has its strengths and weaknesses — so it is prudent to be prepared to present your case taking into account the particular interests of the customer. Incidentally, we offer tailored software to make such calculations easier.

As we said earlier, there is obviously a lot more detail involved in going through the six-step process shown in the first figure in this post, and it requires substantial effort and skills on the part of the supplier – which leads us to one final point:

Strategic account managers and senior salespeople today need business acumen to demonstrate the value they can bring to the customer and the financial literacy to support it.

To do this, they need not just product knowledge but insights gleaned from industry knowledge and from a deep understanding of the customer’s business.

Malcolm is an Emeritus Professor at Cranfield and a Visiting Professor at Henley, Warwick, Aston and Bradford Business Schools. He is Chairman of Brand Finance plc and five small companies, but also spends much of his time working with the operating boards of the world’s biggest multinational companies, such as IBM, Xerox, BP and the like, in most countries in the world, including Japan, USA, Europe, South America, ASEAN and Australasia. He has written 43 books, including the best seller “Marketing Plans; how to prepare them; how to use them.”